TruaID

™

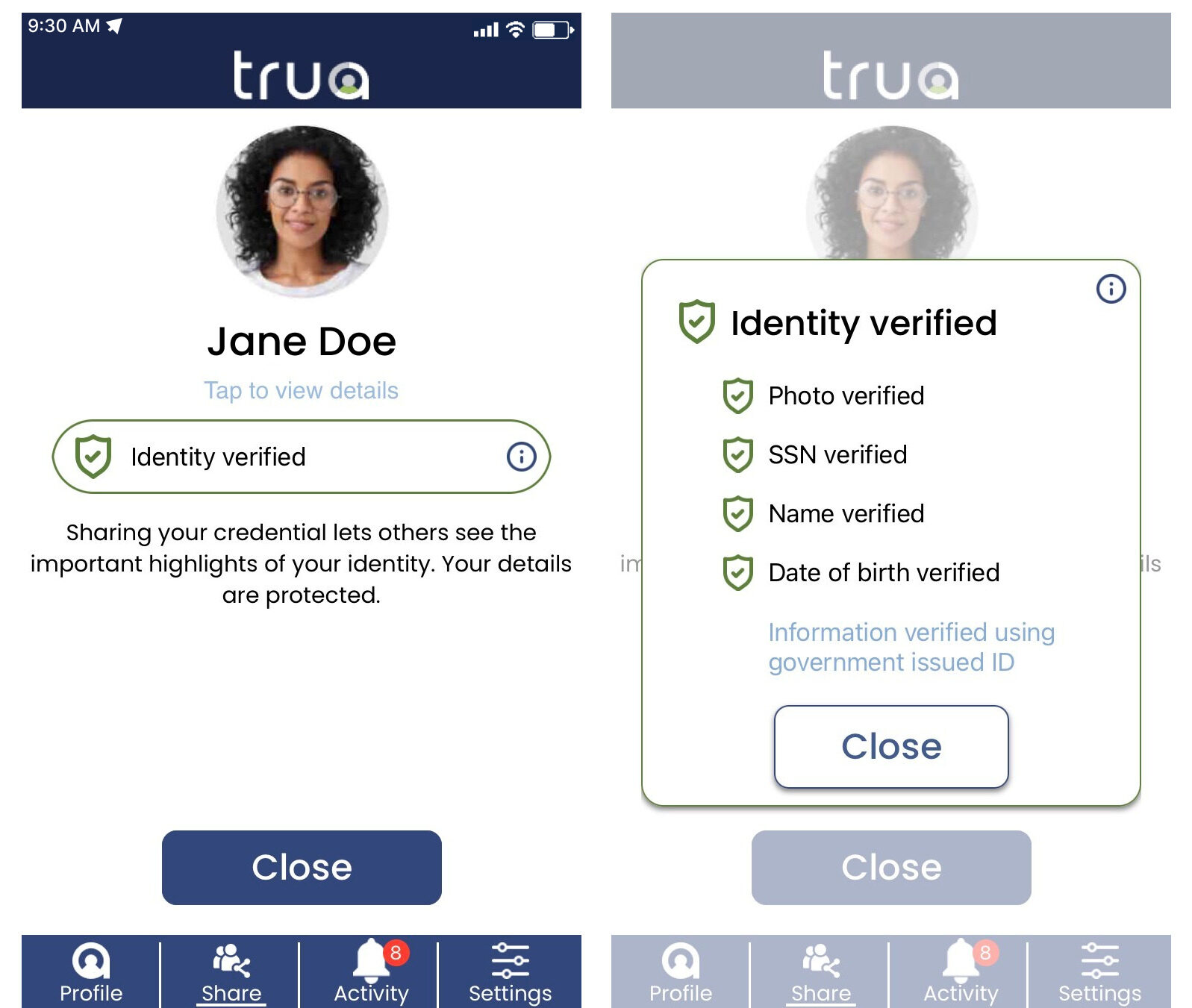

Introducing TruaID™ The Next Generation of Identity Verification. Our solution offers unparalleled security and efficiency, making it easier than ever for businesses to authenticate identities, combat fraud, and enhance user trust.

About TruaID™

What is TruaID™?

TruaID™’s cutting-edge technology redefines the identity verification landscape. Leveraging blockchain for a secure, immutable ledger, and incorporating advanced facial comparison and multifactor authentication, TruaID™ delivers a robust and scalable solution for fraud prevention and seamless user authentication in sectors including:

- Financial and banking institutions

- Fintech companies

- Healthcare providers

- E-commerce platforms

- Telecommunications

- Education institutions

- Government services

- And more

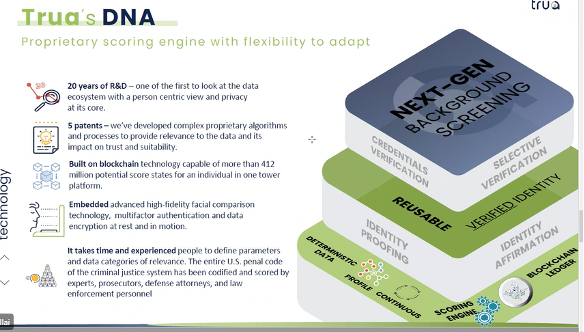

Trua's DNA

How TruaID works™

Our patented technology uses a combination of blockchain, advanced facial comparison, and multifactor authentication to ensure a secure, efficient identity verification process. With TruaID™, businesses can protect against identity fraud, ensure compliance, and build user trust without compromising privacy.

Biometric & Biographic ID

Benefits of TruaID™

TruaID™ seamlessly integrates with existing systems, offering a range of benefits from reducing fraud risk to enhancing customer experience. Discover how TruaID™ can transform your identity verification process.

From financial services to healthcare, TruaID™ empowers organizations to authenticate user identities accurately and efficiently. Discover how TruaID™ is revolutionizing identity verification and building trust across industries.

Transform Your Identity Verification Process with TruaID™

TruaID is designed to benefit a wide range of businesses and industries. Any business or organization that needs to verify the identity of its customers or users can benefit from Trua’s solution. Industries that are particularly well-suited to Trua’s solution include financial services, healthcare, gig platforms, dating platforms, and digital marketplaces. TruaID is the entry point to a platform for such uses as employment screening, tenant screening, background checks, and KYC verification. It can also be used for fraud detection and prevention, as well as compliance with regulatory requirements. Trua’s configurable trust assurance level allows businesses to share the right amount of data for each use case, ensuring that privacy and data protection laws are complied with. Overall, Trua’s all-in-one digital identity solution is a versatile and flexible solution that can benefit a wide range of businesses and industries that need to verify the identities of their customers or users.

TruaID can benefit banks and financial institutions in several ways. First, it can help to streamline the identity verification process, making it faster and more efficient for customers to open accounts or access financial services. Second, Trua’s configurable trust assurance level can help banks and financial institutions comply with KYC regulations, reducing the risk of regulatory fines and penalties. Trua’s solution can be used for a variety of use cases in the financial industry, including identity verification for account opening, loan applications, and credit checks. Additionally, Trua’s fraud detection and prevention capabilities can help financial institutions minimize the risk of fraud, which is a significant issue in the financial industry. Overall, Trua’s all-in-one digital identity solution can help banks and financial institutions improve their customer experience, comply with regulatory requirements, and enhance the security and privacy of their customers’ personal information.

Trua’s configurable trust assurance level can help banks and financial institutions comply with KYC regulations by allowing them to share the right amount of data for each transaction. This means that banks and financial institutions can comply with KYC regulations without requiring unnecessary personal information from customers. Trua’s approach to data minimization also ensures that only the minimum amount of personal information required for verification purposes is collected and stored. By complying with KYC regulations, banks and financial institutions can reduce the risk of regulatory fines and penalties, as well as minimize the risk of fraud and identity theft. Additionally, using Trua for KYC can help to improve the customer experience by reducing the amount of personal information required for verification purposes. Overall, Trua’s configurable trust assurance level provides a flexible and customizable solution for banks and financial institutions to comply with KYC regulations while minimizing the risk of fraud and enhancing the customer experience.

Trua’s approach to data minimization helps banks and financial institutions minimize the risk of data breaches or identity theft by collecting only the minimum amount of personal information required for verification purposes. Trua achieves this through the concept of selective disclosure, which allows users to control which pieces of personal information are shared with relying parties. Trua employs multiple measures to protect user data, including the use of encryption techniques to ensure the security of the data, and access controls to limit the number of individuals who can access the data.

Yes, Trua can integrate with existing business processes for identity verification and fraud detection. Its all-in-one ID proofing, fraud detection, and user authentication and screening solution can be easily integrated with any existing business processes geared towards trust verification. Trua’s platform is designed to be flexible and configurable, allowing businesses to customize the solution to meet their specific needs. This means that businesses can leverage Trua’s advanced technology and expertise to improve their existing identity verification and fraud detection processes without needing to implement a separate system. By integrating Trua’s solution, businesses can enhance their existing processes and minimize the risk of fraud, all while streamlining their verification process and improving the overall customer experience.

Trua offers three methods of integration for businesses to incorporate its digital identity solution into their existing systems: API, blockchain, and database federation. The API integration method involves a RESTful API that allows businesses to connect to Trua’s digital identity solution and access its various features and functions. The blockchain integration method involves leveraging the power of blockchain technology to create a decentralized and secure platform for identity verification and fraud prevention. The database federation integration method involves federating data from different sources and integrating them into a single, unified platform for identity verification and fraud prevention. By offering multiple methods of integration, Trua enables businesses to choose the method that best suits their needs and existing infrastructure.

Yes, Trua enables the digital identity verification experience to be white labeled for use in your consumer channel. This means that you can customize the user interface and branding to match your own brand identity. Additionally, we will be releasing a native toolkit for mobile wallet makers to embed the Trua digital identity verification experience directly into their mobile wallets. This will enable your customers to seamlessly and securely verify their identities within your mobile application, further enhancing the user experience and trust in your brand.

We have a robust set of APIs that make integrating into the Trua Exchange a very straightforward procedure. For more information on our APIs, please see the Resource Center or contact us.

Trua is committed to maintaining the highest operational standards to protect data and to ensure compliance with federal and international requirements. Trua utilizes advanced levels of authentication, encryption, and data security protocols. For detailed information please contact us.

about trua

Trua is a first of a kind reusable verified identity and screening company that provides all-in-one ID proofing, fraud detection, authentication, and screening through its Trua platform. With Trua, businesses can onboard customers seamlessly and authenticate them without requiring personal information, which enhances Trust and confidence to both parties.

Solutions

Company

Subscribe to newsletter

Enter your email below and receive our resources directly to your inbox